Insights from the IVD Track at MedTech Summit 2025

The IVD track at MedTech Summit 2025 in Berlin brought together regulators, notified bodies, and industry experts to examine the continuously evolving regulatory landscape for in vitro diagnostics (IVDs). Over two days, discussions spanned IVDR implementation, the progress of future UK regulation, considerations for IVD and companion diagnostic performance studies, global approaches to in-house and laboratory-developed tests, readiness for EUDAMED, and the first operational experience with EU Reference Laboratories (EURLs). For regulatory leaders, the sessions underscored not only immediate compliance requirements but also broader strategic imperatives:

- Managing portfolios under changing regulations

- Strengthening post-market obligations

- Preparing now for forthcoming demands such as EUDAMED registration and EURL engagement

Success in the IVD space now requires more than regulatory awareness—it demands foresight, adaptability, and a partner who can bridge operational realities with evolving expectations. The conversations in Berlin underscored this need for strategic guidance, not just reactive compliance. Beaufort continues to lead in this space—helping sponsors anticipate change, interpret evolving requirements, and implement pragmatic solutions. The insights below highlight the most critical developments and their implications for diagnostic developers and sponsors.

IVDR Implementation in the EU

Implementation of the IVDR continues to advance. By late 2024, approximately 1,273 (QMS and product) certificates had been issued, including 377 for Class D devices and 32 for companion diagnostics, against an estimated 40,000 IVDs on the EU market.

Navigating shifting regulations requires foresight, not just compliance. Beaufort helps sponsors and manufacturers anticipate evolving requirements, implement pragmatic solutions, and accelerate patient access.

Timelines remain long. Total average time to complete QMS or Technical Documentation certifications each typically require 13–18 months, with much of that time consumed by iterative Notified Body questions and requests for supplementary evidence. Industry and Notified Bodies have submitted proposals to establish predictable timelines.

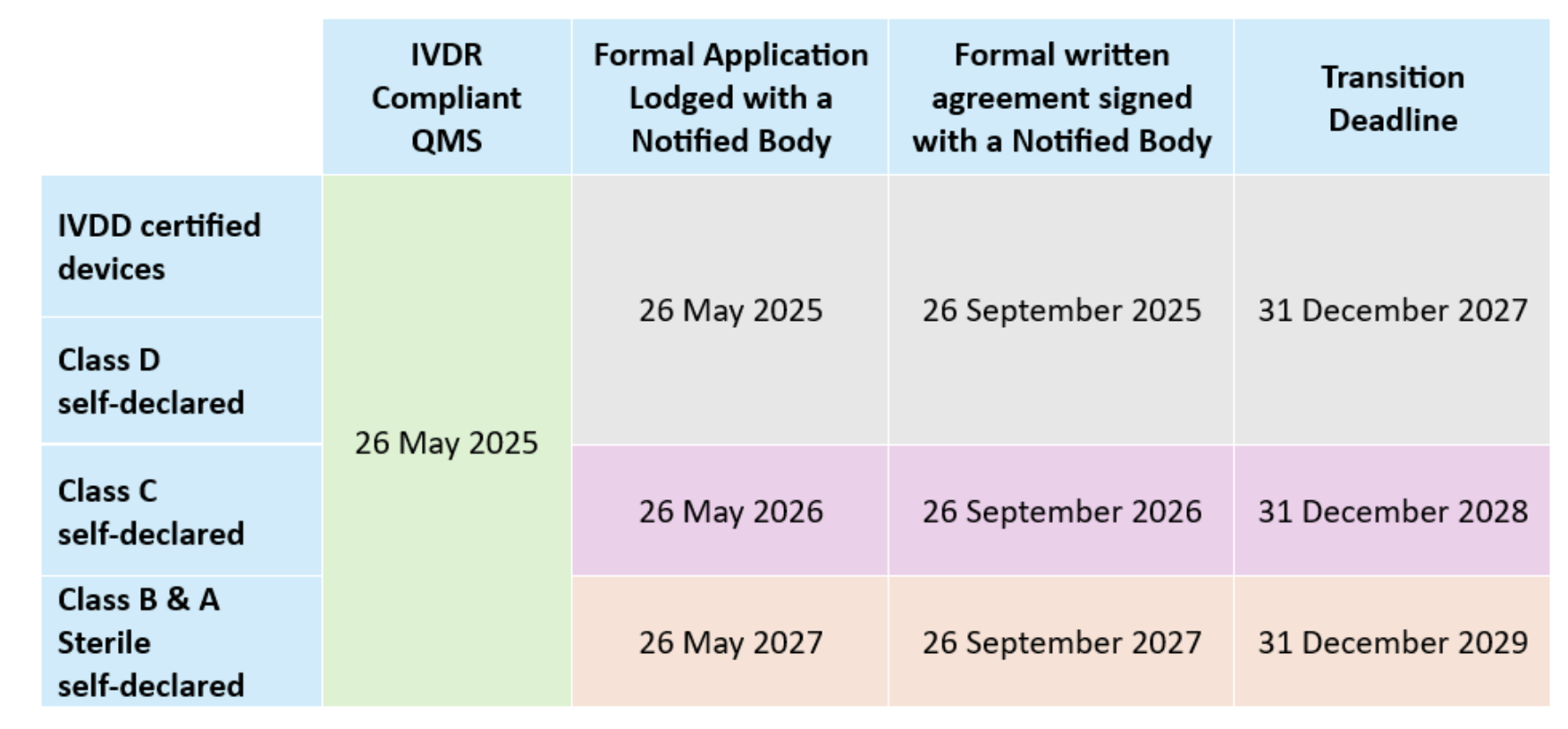

Transitional provisions. Regulation (EU) 2024/1860 published in July 2024 allows eligible legacy IVD devices to remain available provided they undergo no “significant change” (per MDCG 2022-6), continue to comply with IVDD requirements:

Guidance and interpretation. Although more than 120 MDCG documents are now in circulation, key guidance is still missing and guidance is changing over time (e.g., Covid test down-classification from D to B and changing EMDN numbers) which is complicating planning. Updates to documents such as MDCG 2019-6 on structured dialogue are designed to smooth Notified Body–manufacturer interactions, however the guidance focuses on the “what” without providing the “how”. Additional new guidance is expected for IVDR orphan devices; MDCG 2019-13 on sampling devices for assessment of Technical Documentation; Q&A on the AI Act, PSUR evaluation reports, Q&A regarding IVD performance studies (now available), and a Q&A regarding distance sales among others.

Notified Body Capacity has improved. Notified bodies stressed that staffing investments have eased the bottlenecks. The real challenge now is manufacturers delaying submissions and the quality of manufacturer submissions. Files that are incomplete or inconsistent trigger lengthy review cycles.

The UK MHRA’s Developing Framework

Dual system remains in place. Great Britain (England, Scotland, and Wales) operates under MHRA’s sovereign model, while Northern Ireland continues to align with IVDR. Because the UK’s Medical Devices Regulations 2002 can only be amended rather than rewritten, MHRA has relied on a series of legally required public consultations to move reform forward.

Post-market surveillance is now fully in effect. As of June 2025, PMS obligations apply in Great Britain. These mirror EU IVDR concepts in many respects—risk-based planning, PMS plans and reports, periodic safety update reports (PSURs), trend reporting, and vigilance requirements including incident and FSCA reporting. However, reporting timelines differ, and further MHRA guidance is expected.

Premarket classification will shift to four risk classes. Future statutory instruments will align IVDs with a four-class risk framework based on patient and public health impact. Requirements for market access will be scaled accordingly. MHRA has specifically sought views on regulatory requirements for Class B IVDs, including software IVDs. Options under consideration include allowing manufacturers to self-assess conformity with the regulations while holding ISO 13485 QMS certification from a UKAS-accredited body.

Reliance and recognition models are being developed. MHRA is evaluating pathways that would allow devices already approved by trusted regulators—such as in Australia, Canada, the EU, or the USA—to access the GB market more quickly. These devices would still need to meet GB-specific requirements, including English labelling, a UK Responsible Person, unique device identification (UDI), and compliance with UK post-market surveillance (PMS) obligations.

Fees are increasing. MHRA continues to raise fees in order to sustain its role as a sovereign regulator. This trend will weigh most heavily on smaller developers.

Reform remains a long-term process. Even with consultations and amendments under way, meaningful structural change will take several years. In the meantime, companies must operate under hybrid arrangements while preparing for further reform.

Biomarker Testing in Clinical Trials

Synchronizing drug and diagnostic development timelines is essential to contemporaneous marketing authorizations. Beaufort brings the regulatory and operational expertise to assure IVD submissions are timely and complete, keeping programs aligned.

Defining medical purpose is critical. When a biomarker assay is used to determine patient inclusion or exclusion, guide therapy, or support monitoring, it is deemed to have a medical purpose under IVDR and requires a clinical performance study (CPS). By contrast, assays used solely for stratification or exploratory endpoints may fall outside IVDR scope. However, where data are intended to support CE marking, the trial must still be conducted to IVDR and ISO 20916 standards.

Obligations extend to early-phase studies. Even Phase I trials may trigger IVDR requirements if assay results influence patient management. This includes the obligation for independent monitoring of testing sites, as outlined in Article 68 and Annex XIV.

Combined studies present operational risks. Trials involving multiple pharmaceutical sponsors or diagnostic partners create challenges around data ownership, confidentiality, and clinical trial/performance study timelines. In practice, separate CTA and PS submissions are often the more reliable approach, reducing risk of delay or dispute.

Repurposing CE-marked diagnostics is not straightforward. Using an existing CE-marked diagnostic in a new therapeutic context frequently requires a new clinical performance study, along with updates to the technical documentation, risk management files, and labeling. Sponsors must anticipate these requirements early to avoid disruption.

Pharma-Diagnostic Collaboration – Combine Studies

Early alignment is essential. Regulatory strategies for diagnostics must be developed in parallel with medicinal product plans. Deferring diagnostic planning risks misalignment and late-stage delays.

Roles and responsibilities must be explicit. Collaboration agreements should clearly define who holds responsibility for regulatory submissions, who engages with regulators, and how decision-making authority is exercised across partners.

Rapid response capacity is expected. Regulators such as FDA and EMA often require answers to queries within days or even hours. Effective partnerships now require coordinated rapid-response mechanisms across pharma and diagnostic teams.

Patient access is directly affected. If companion diagnostics are not available at the time of therapeutic launch, drug approvals may stall, or patient access may be delayed. Synchronizing drug and diagnostic timelines is therefore no longer optional; it is a core requirement of development strategy.

Global Perspectives on LDTs

United States. The FDA’s attempt to regulate LDTs through a phased rule was struck down in 2024. Oversight now rests primarily with CLIA (CMS), except where LDTs are used in clinical trials, in which case FDA retains authority under IDE provisions of 21 CFR 812. Industry noted that FDA has signaled concerns when multiple LDTs are used without demonstrating even “minimal” performance; such situations are likely to trigger review discussions if sponsors later seek regulatory approval. In parallel, New York State’s CLEP program continues to operate independently, creating an additional layer of oversight.

European Union. Under IVDR Article 5(5), LDTs are restricted to in-house use within a healthcare institution, and only if no CE-marked equivalent device exists. Full application of these provisions began in May 2024. Article 6 provides the framework for distance sales, requiring that devices supplied to EU patients—whether purchased online or when EU patient samples are tested outside the Union—must still comply with IVDR requirements. In practice, this closes a potential loophole and ensures equivalent regulatory expectations for devices regardless of distribution route.

United Kingdom. Great Britain continues to rely on legacy IVDD-based provisions. Stakeholders see this as an opportunity to design a pragmatic, risk-proportionate framework, particularly for use in clinical trials, which could potentially become a model for future alignment.

Themes and challenges. Regulatory harmonization across jurisdictions remains unlikely. In the EU, reimbursement structures differ significantly by member state, compounding the regulatory complexity. Definitions of what constitutes a “healthcare institution” also vary, which affects feasibility for sponsors. At a broader level, innovation pathways remain poorly defined, and the pandemic experience underscored that preparedness depends on adaptive and flexible frameworks rather than rigid rules.

Post-Market Surveillance: Distributor Interfaces

A strong message came through on PMS under both MDR and IVDR as the new PMS requirements came into force during the conference.

Surveillance extends beyond vigilance. Vigilance addresses the reporting of serious incidents, whereas PMS requires manufacturers to establish systematic and proactive processes to detect trends, analyze data, and act on findings before they escalate into incidents.

The distributor–manufacturer relationship is central. Effective PMS cannot operate in isolation. Agreements must obligate distributors to channel customer complaints, sales representative observations, and user feedback directly to manufacturers. Contracts should require immediate notification, active participation in surveys, and cooperation in implementing CAPAs, field safety corrective actions (FSCA), or recalls.

Risk of regulator bypass. Under IVDR Article 14(6), competent authorities may approach distributors directly. Without robust contractual controls, there is a risk that distributors provide incomplete or unfavorable information. Agreements should therefore require manufacturer review and approval of responses before communications are made to regulators.

UK and EU expectations differ. The UK requires reports even where uncertainty remains, placing greater emphasis on early reporting, on user feedback, and on data gathered from other jurisdictions. Manufacturers operating in both systems must ensure PMS structures can accommodate these differing expectations.

Intersection with the AI Act. For devices incorporating artificial intelligence, the AI Act introduces obligations for monitoring and logging of performance in the field. This will necessitate even closer coordination between manufacturers and distributors to ensure that data capture and reporting are comprehensive and compliant.

EUDAMED – Phased Implementation and Practical Lessons

Phased implementation under Regulation (EU) 2024/1860.

Phased EUDAMED rollout readiness demands more than data entry—it requires cross-functional alignment and proactive planning. At Beaufort, we translate complexity into clear, actionable steps for timely implementation.

- From January 2026, mandatory use of the Actor Registration, UDI/device registration, Notified Body & Certificates, and Market Surveillance modules will apply to new devices.

- The Vigilance module will follow from Q3 2026, with full functionality expected by Q2 2027.

- Development of the Clinical Investigation/Performance Studies (CI/PS) module will continue into Q3 2026. An audit to assess CI/PS alongside the other five modules will take place once its minimum viable product has been delivered.

Operational challenges identified.

- Documentation remains voluminous and often inconsistent, spanning MDR/IVDR, MDCGs, and implementing acts.

- Unpublished “triggers” and discrepancies between the playground and production environments continue to create avoidable failures.

- Data submission routes carry differing risks: manual entry is impractical, XML upload is limited, and machine-to-machine (M2M) connections—preferred by the Commission—take six months or more to establish. Companies starting late are unlikely to achieve readiness in time.

- EUDAMED functions as a minimum viable product with little built-in validation; compliance must therefore be assured within manufacturers’ own systems.

- Portfolio prioritization is uneven. With many companies delaying registration, late surges near deadlines will overwhelm Commission support capacity.

Lessons emphasized at the Summit.

- Treat EUDAMED as a cross-functional initiative, not a project confined to regulatory teams.

- Align with other data-sharing regimes such as FDA’s GUDID and SwissDAMED to reduce duplication and ensure consistency.

- Register devices most likely to generate vigilance reports first to minimize downstream disruption.

- Do not assume the regulation is static; the Commission continues to introduce new and revised requirements with little advance notice.

EU Reference Laboratories (EURLs) – Implementation of Regulation (EU) 2023/2713

IVD Class D conformity assessment now formally involves EURLs

Role and mandated tasks. For Class D devices, EURLs are now formally embedded in the conformity assessment process. Their responsibilities include verifying manufacturer performance claims through independent laboratory testing and confirming compliance with relevant common specifications.

Designation status. As of December 2023, five laboratories had been designated, covering hepatitis/retrovirus, HIV, bacterial agents such as Treponema, and respiratory viruses. Blood grouping and parasitology are not yet covered; however, applications for devices in these categories may still be submitted to notified bodies in the absence of an EURL designation.

Operational launch. EURLs became fully operational on 1 October 2024, when the first physical batch testing began. Harmonized contractual frameworks between laboratories and notified bodies were finalized in December 2024.

Timelines for review. EURLs are required to deliver their opinions within 60 days of receiving the necessary materials. Batch testing applies to each defined production lot.

Different application scenarios.

- New applications submitted after 1 October 2024: both performance verification and batch testing are required.

- Applications lodged before 1 October 2024: batch testing is required, but performance verification is deferred until renewal.

- Devices already certified: batch testing applies immediately, with performance verification added at the next renewal.

Practical challenges observed. Manufacturers are already encountering operational hurdles, including the logistics of transporting batches and instruments, preparation of QC documentation, customs delays, and variability in laboratory transparency. Fees also differ across labs, adding complexity to planning.

Future expansion. A second round of designations is under way to cover blood grouping and additional pathogens, with further EURLs expected to come online in the coming years.

Conclusions

Collaboration is central. Structured engagement across regulators, notified bodies, distributors, and pharmaceutical partners is no longer optional. It is the mechanism through which organizations will navigate change and safeguard patient access.

The regulatory environment remains unsettled. The MedTech Summit 2025 IVD track highlighted that Europe’s IVDR implementation, the UK’s developing medical device regulatory framework, and global divergence in LDT oversight continue to evolve, with new obligations such as EUDAMED adding further complexity.

Strategic leadership is required. For senior regulatory professionals, the challenge extends beyond meeting today’s compliance requirements. Success will depend on anticipating regulatory developments, executing with discipline, and embedding foresight into portfolio and development planning.

How Beaufort Can Provide Support & Expertise

At Beaufort, we work alongside diagnostic developers, pharmaceutical sponsors, and laboratories to navigate the evolving regulatory landscape. Our team brings decades of experience in regulatory strategy, clinical performance study execution, and post-market compliance across global frameworks. We understand the practical realities of engaging with regulators, aligning cross-functional partners, and preparing for new obligations.

As the regulatory climate continues to evolve, the value of a partner who adapts to change, streamlines submissions, and provides operational oversight across jurisdictions is clear. Beaufort combines deep regulatory expertise with hands-on operational experience to ensure programs advance with confidence and patients gain timely access to innovative diagnostics.

For more information on how Beaufort can support your regulatory strategy, contact us directly at [email protected] or provide your contact information here.